Case Study – McMeekins Cleaning

Client:

Industry:

Residential and Commercial Cleaning, End of Lease, Oven Cleaning, Window Cleaning

Goals with the site:

From our first appointment our client highlighted their need for a website as well as some graphic design work including vehicle signage, a promotional flyer and some work on their social media pages.

A website build was particularly important for the client as they wanted to promote their cleaning services and the areas they service in and around the Sunraysia district.

We also identified the need for both Google My Business & Bing Business Listings.

The process:

Once we identified the work to be done, we created a plan with the client so that Marketing could be done in stages across a couple of months and in a progressive order.

We started by assessing and doing works on the existing Facebook page including design of a new coverpic, post with cartoon character announcing services and updating logo and business description.

This was followed by vehicle signage design with print ready files sent to the signwriter.

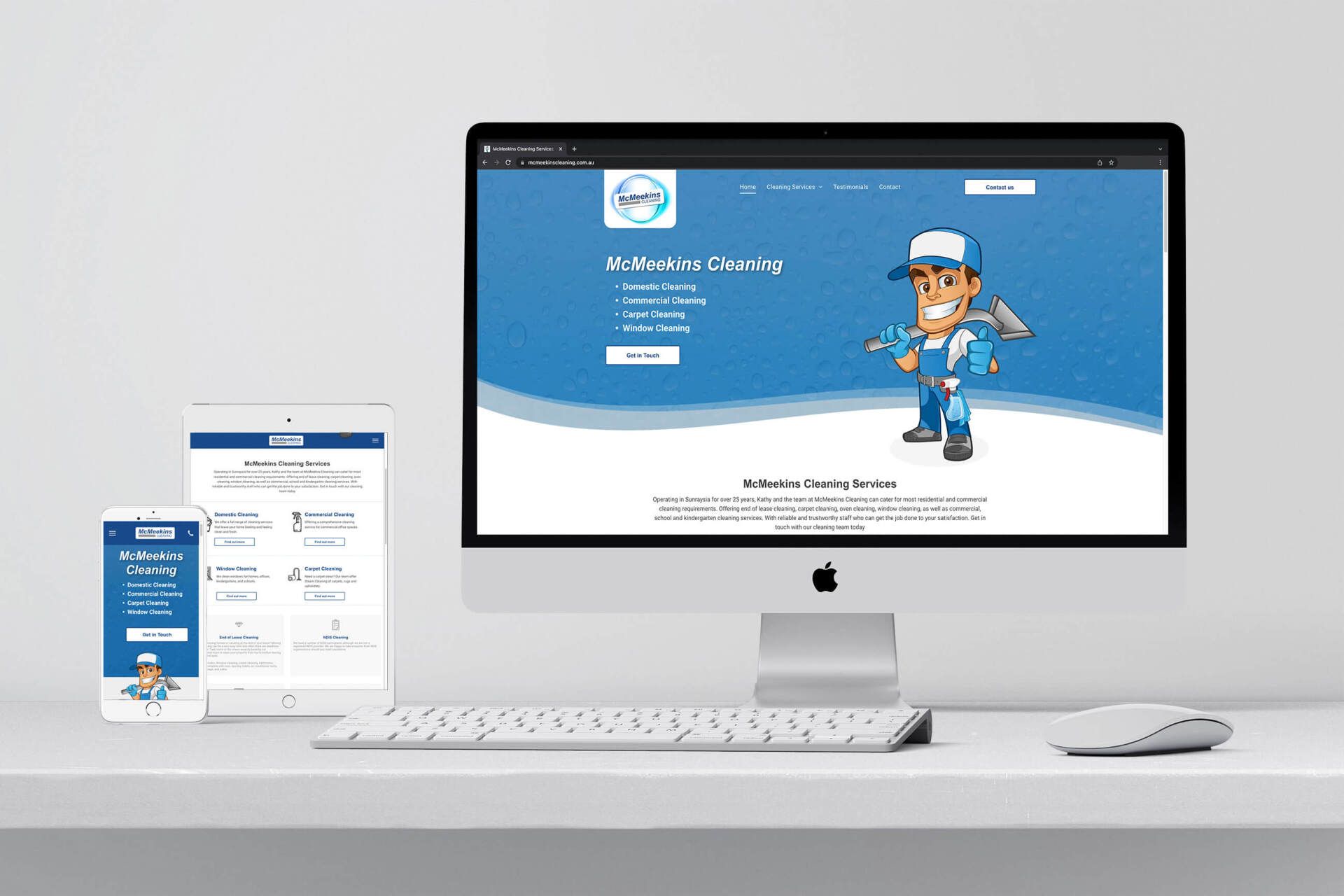

Website works started with a clear plan of pages and sections that were identified during talks with the client.

Copy writing - Basic terminology was provided and then text expanded upon by Marketing Manager Rachel.

A new flyer has also been designed in line with branding to promote business services and includes the new website address with print ready artwork sent to the local printer.

Our graphic design team were able to re-create the client’s logo as well as design of cartoon characters that would form the basis of the design work. The team collaborated to create a consistent and clever design to match in with the clients existing brand and colours.

Following this, the marketing team designed and developed the website with an easy to find dropdown section to the types of cleaning services offered by McMeekins Cleaning.

Our team were able to obtain professional images for use on the website without needing to use private photos. These photos are generic but clearly align with the purpose of each cleaning page and section.

We also created both Google My Business and Bing Business listings so that McMeekins Cleaning can be found easily in the online world and called directly from a Google search on a mobile phone.

Visit the website at www.mcmeekinscleaning.com.au

To find out more, contact any of our friendly Marketing team today.

Latest News