Starting a business? What Marketing do you need and in what order...

It’s exciting right? Starting your own business may have been a dream you’ve had for some time - we get it!

Although it can be overwhelming there are some simple steps you can put in place that will give your business a really good grounding in presence especially online.

Step 1: Develop a brand

More than a logo, a brand is what your business stands for - it is also the memory someone has after an interaction with your business.

But a great place to start is a logo - it helps identify you to customers, separates you from competitors and also gives your business an identity it can have for many years to come.

Step 2: Google My Business and Bing Business listings.

These are business listings provided on the Google and Bing search engines. They contain all contact details, opening hours, business descriptions and images of your business. They’re inexpensive and a great first step before investing in a website.

Step 3: Marketing Plan

It can be exciting to get your brand ‘out there’ by advertising right away but you need to be careful to plan it out. Establish a target audience (your ideal customer), then work advertising and marketing toward that customer.

A good place to start is to get a 12 month calendar and add to it action items like advertising, website build, social media posts etc to enure you give yourself a to-do list you can refer back to.

Step 4: Social Media

Developing a social presence is becoming more and more important. But which platform is best for your business? Facebook, Instagram, Twitter, LinkedIn, YouTube, TikTok or SnapChat? Each have their audiences and each have differing ways to advertise on them.

Once you choose, posting regularly is key - good quailty information that can help your customers understand your business offering, not just ads.

Step 5: Website

Likley the first place someone will go when looking for your service or product is online. 85% of word-of-mouth referrals check your business out online before contacting you. So your website is really the front door of your business to potential customers.

Websites have a lot of moving parts, like SEO, Call-to-Action, Product Offering - so it is important to get the site designed by someone who has lots of experience.

Step 6: Advertising

The last step and with good reason - it can be expensive, so you want to make sure you have the first steps in place first. No good attacting a customer to your website if it isn’t ready to accept enquiry - or getting them to follow your business on socials and having no content to show them.

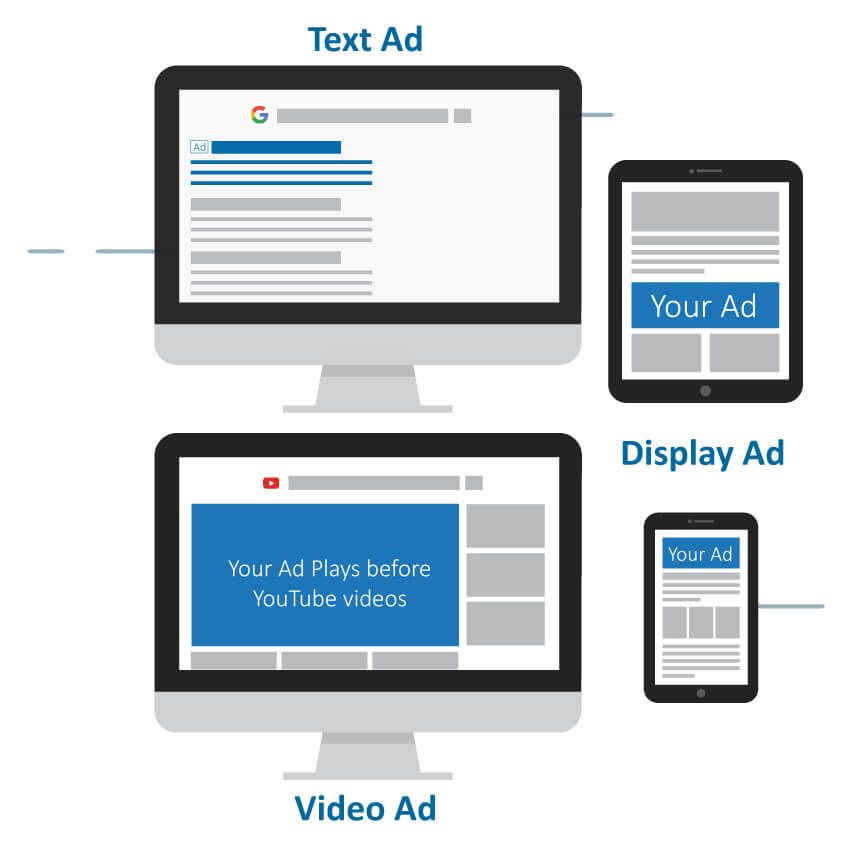

Lots of options here from TV to Radio to Newspaper to Social Boosts and Google Ads. All have their own ways of reaching your ‘ideal customer’ from Step 3 in the plan. Keep this customer in mind at all times and you should get good results.

Our Marketing Team offer assistance in all of the items mentioned above. Contact us today for a FREE initial consultation to step you through what is possible for your business.

Latest News