The Outlook is Bleak, Should I Stay Invested?

A story of three charts

Many investors are understandably feeling wary from the dizzying roller-coaster ride of the last three or so years. The unbridled optimism of 2019 was cut short by the pandemic-induced market crash in 2020, which was itself followed by a lightning-fast recovery that surprised even the most optimistic analysts. By the time we caught our breath in 2021, we were greeted in 2022 by news of out-of-control inflation, and almost just as quickly, by a looming recession. The RBA is now intent on increasing cash rates further, which could potentially aggravate losses in shares, bonds, and real estate. With an outlook so bleak, many investors are legitimately wondering whether they would be better off sitting out the next few months or even years.

It may sound counterintuitive, but the very fact that markets have fallen so far this year is actually a positive sign. There is a rational explanation for this: markets are comprised of millions of savvy investors who project into the future. Prices adjust as soon as clouds are on the horizon, rather than when it starts raining. If it’s in the news, it’s already in the price, and there’s therefore much less of a reason to worry about it from this point onward.

However, one could still argue that there’s ample room for the situation to worsen, or to stretch the metaphor, for the rain to linger much longer than originally expected (a bit like a third La Nina summer in a row…). Only in hindsight will it become obvious that we had reached the bottom, but at this stage we could be only half-way through.

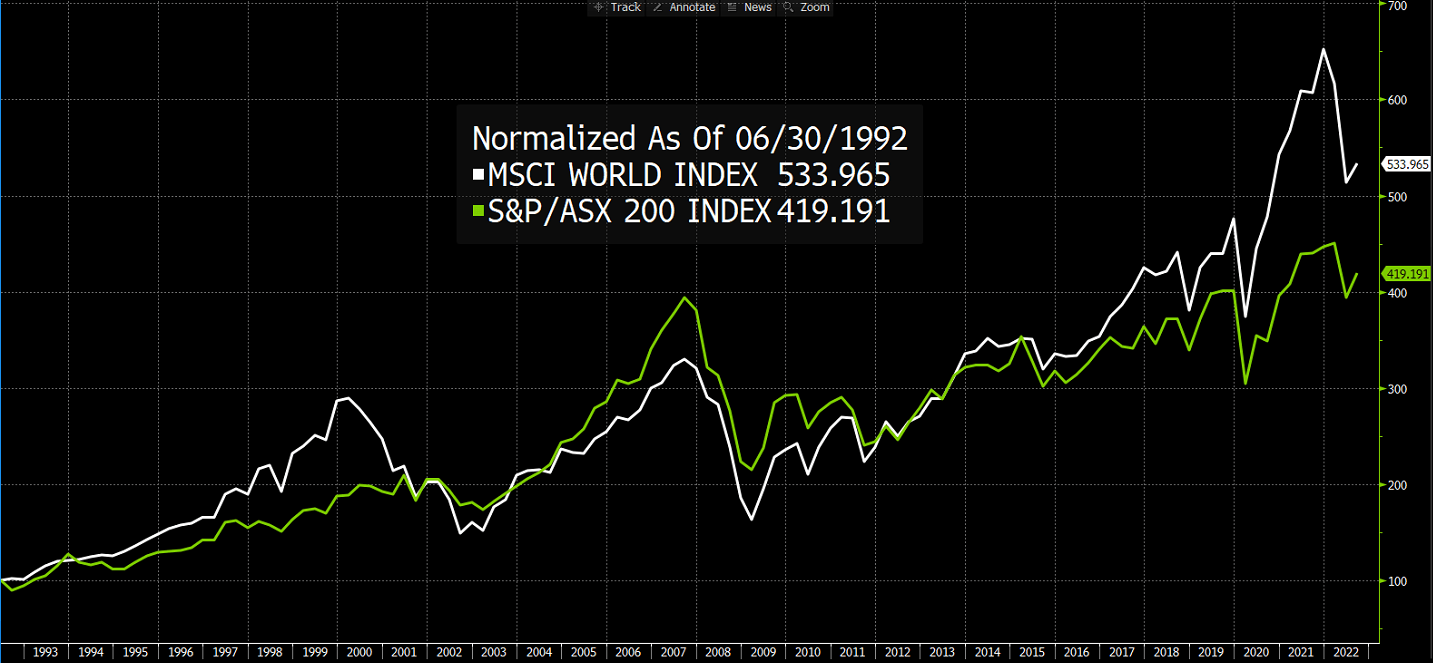

Faced with a similar question a number of years back, Warren Buffet answered as follows: ““In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497”. In other words, the bad news eventually fades away and markets resume their march up. The biggest risk for long-term investors is therefore not the downturn but rather missing out on the recovery. The chart below makes this case even more obvious than the Oracle:

$100 invested in international or Australian shares in 1992 would have grown to $534 and $419 today, despite the tech-bubble crash of 2000-2001, the GFC, COVID etc.

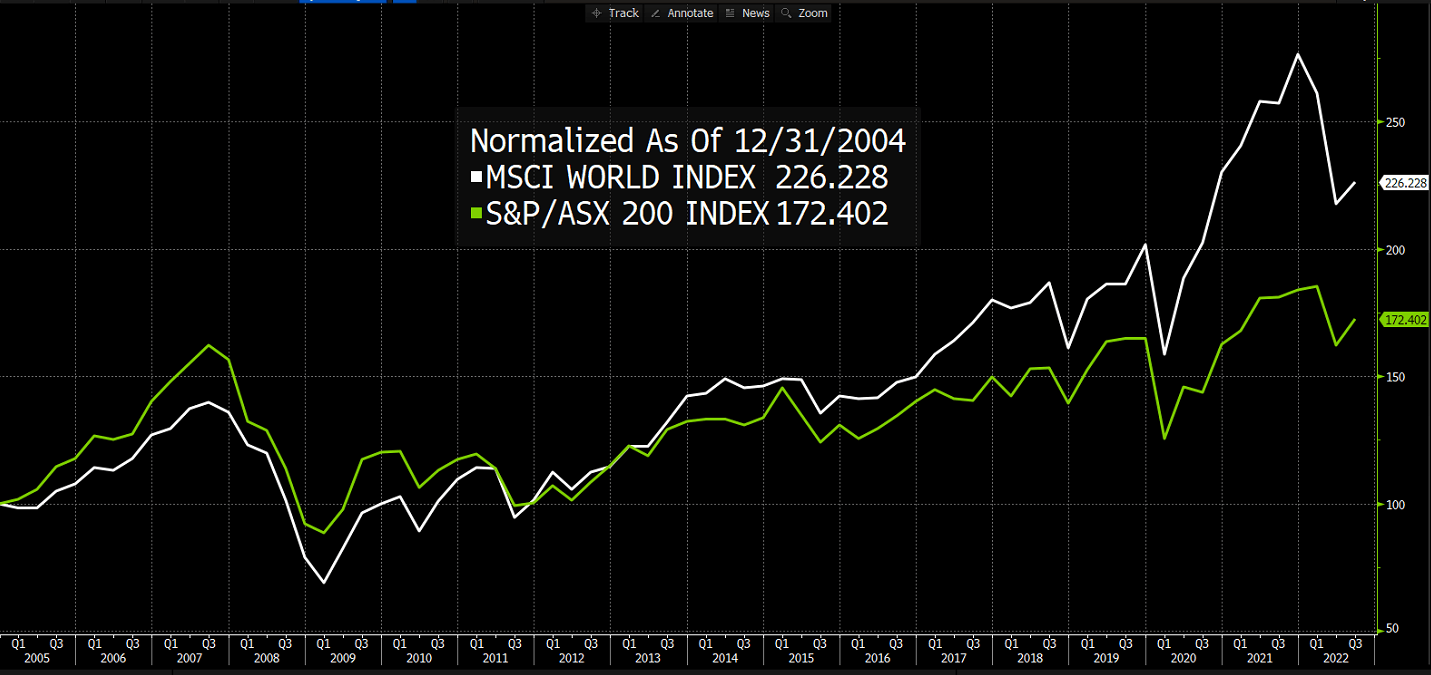

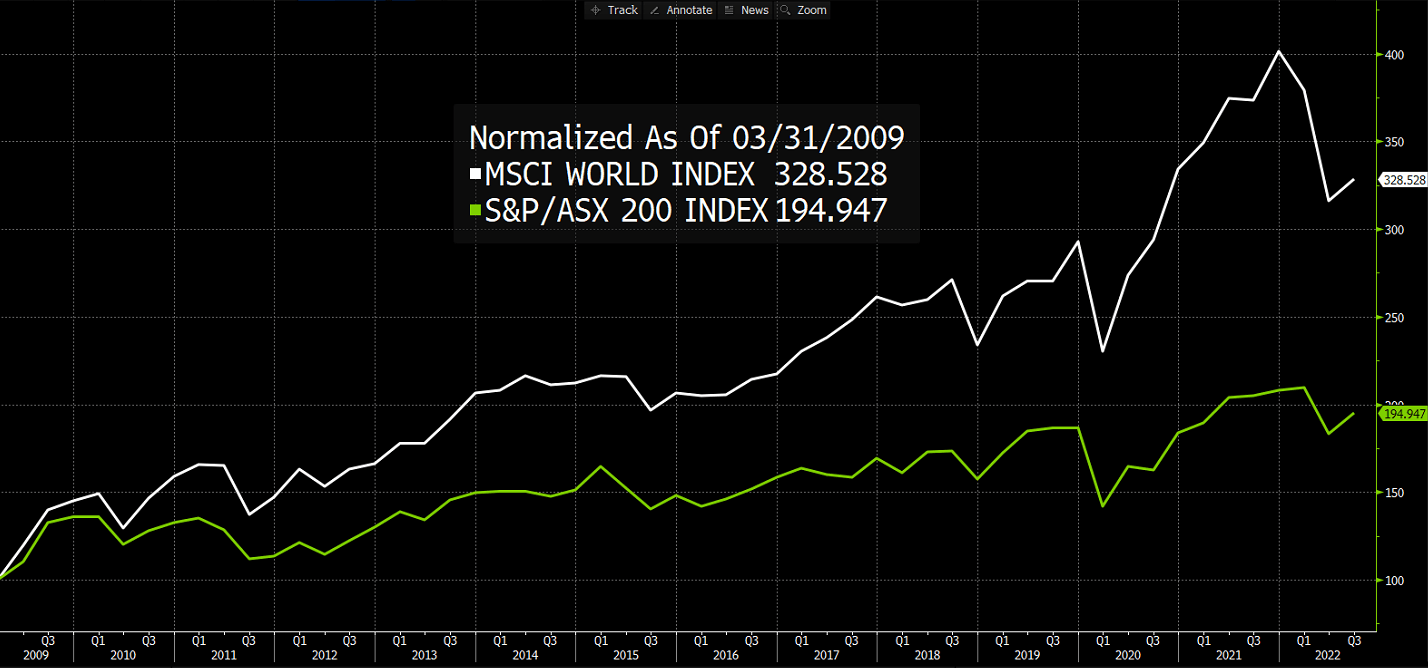

But the news gets even better. Not only should investors not fear losses, they should see them as opportunities. Time and again, bouts of extreme pessimism have often marked the starting point for the next market rally (and vice-versa). Think about the depth of the GFC in January 2009 or COVID in March 2020. Additional money invested during these downturns (like regular super contributions) would have benefited from the higher return rates of the recoveries. The 2 charts below illustrate this point: $100 invested in international shares at the beginning of 2005, a period that can be described as “mid-cycle” (neither very bullish nor very bearish) would have grown to $226 today. But an additional $100 invested a few years later during the depth of the GFC would have grown to $328!

Here too, the depth of the GFC is only obvious with the benefit of hindsight. But regardless of where markets head to in the short-term, the fact is that investors today can buy shares at a 10-15% discount to the price they happily paid only a few months ago! Market falls bring out irrational behaviour but educated investors can use it to their benefit.

Jesse Jury

Financial Planner

Latest News